We are now accepting Form 941 for Q2, 2024!

Cloud-Based Form 941 Efile Software for 2024

You can File 941 electronically with our software

How to File Form 941 Electronically with the IRS?

-

Choose Quarter & Tax Year you are filing for

As we support prior year filing as well, you will be prompted to file 941 online for the quarter and tax year of your choice.

-

Enter Form 941 information

You will be walked through the step by step process which helps to complete your file 941.

-

Review your Form and Transmit to the IRS

You will be taken to the Form summary page where you can see your form information. If you found any correction you can edit right from there and transmit your return to IRS directly through our software.

Features that simplifies your 941 Efile

Internal Audit Check

Apply 94x Online Signature PIN for Free

IRS Authorized

Instant Filing Status

Access Form Copy Anytime

U.S Based Customer Support

Timely Deadline Reminder

File 941 for Prior Years

In additional, Tax Professionals can avail the following features

Manage Multiple Businesses

Use the 941 Bulk Upload Template to upload all the 941 information instantly. Save taken in manually uploading your data.

Bulk Upload Template

Tax Professionals are provided with Bulk Upload Template to upload all their clients 941 information into our system instantly.

Learn more about TaxBandits Features

When are the Form 941 E-filing Deadlines for the 2024 Tax year?

First Quarter

January - March

April 30, 2024

Second Quarter

April - June

July 31, 2024

Third Quarter

July - September

October 31, 2024

Fourth Quarter

October - December

January 31, 2025

Know more about Form 941 Deadlines.

File 941 electronically before the deadline and stay tax-compliant!

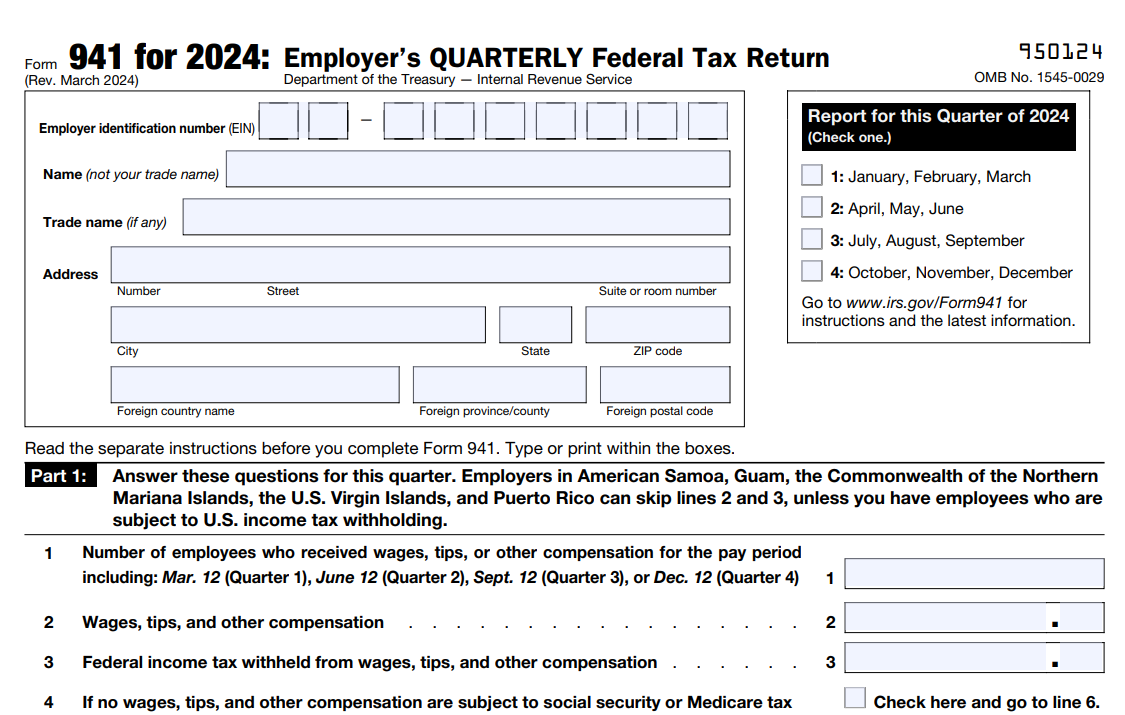

How to E-File 941 Form for 2024?

E-File Form 941 by following these simple steps and file your Tax return to the IRS for the quarter.

Below are the steps that you need to follow to e-file 941

Enter Form Information

To file 941, enter business information, wages paid to employees in the quarter and the respective taxes withheld.

Review Information

Review the entered information in 941 Form. If you find any errors in the return, edit the information, and sign the return.

Transmit to IRS

Transmit the return directly to the IRS. You’ll be notified of the status when the IRS approves your return.

What are the Changes in Form 941

for the 2024 Tax Year?

- The Social Security wage base limit has been raised from $160,200 to $168,600.

- Household workers earning $2,700 or more in 2024 will now be subject to Social Security and Medicare taxes.

- Election workers receiving $2,300 or more in cash or its equivalent form of compensation will be liable for Social Security and Medicare taxes in 2024.

- Businesses will no longer be able to claim COVID-19-credits for qualified sick and family leave wages on Form 941.

- Forms 941-SS and 941-PR are to be discontinued after 2023. Instead, employers in the U.S. territories will use Form 941 to report their tax withholdings or, if they prefer a Form in Spanish, they can file using the new Form 941 (sp).

Visit https://www.taxbandits.com/revised-form-941-changes-for-2024/ for more information on Revised Form 941 for 2024.

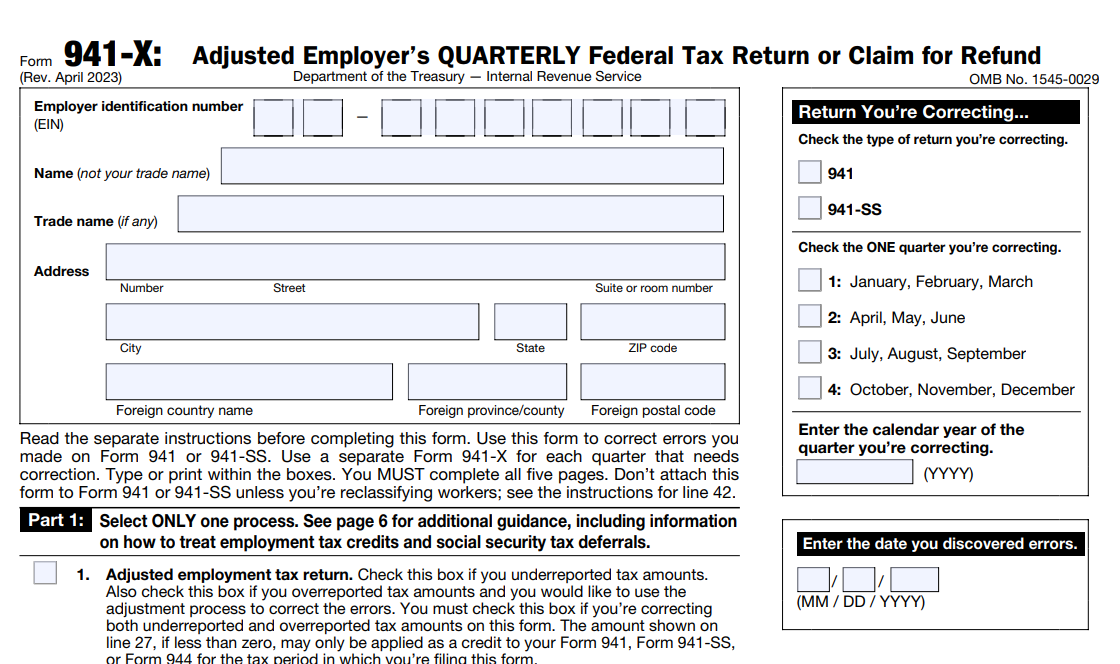

What is IRS Form 941-X?

Form 941-X is a tax form used to correct errors on your previously filed Form 941 Tax. With Form 941-X, you can correct both the overreported and underreported taxes using this correction form.

- If you’re correcting overreported taxes, you can use the excess tax amount to file your next 941 or claim a refund.

- For underreported taxes, you must pay the remaining tax amount along with your 941-X.

Filing Form 941-X for underreported taxes may result in penalties, however the IRS may waive these penalties if you can show a reasonable cause.

How to Sign your Form 941 when you E-File?

Do you know that you are required to sign your Form 941 to

E-file it with the IRS?

Yes. In order to complete and e-file your Form 941 with IRS, you need to either use 94x Online Signature PIN or Form 8453-EMP.

Our Software is capable of providing both the features for you to e-file your Form 941.

You can apply for a 94x online signature PIN for free with our 941 e-file software and you can expect your PIN from IRS within the 45 days of applying. If your 941 Form is due and you need to file it immediately, you can use Form 8453-EMP to sign your Form 941 online.

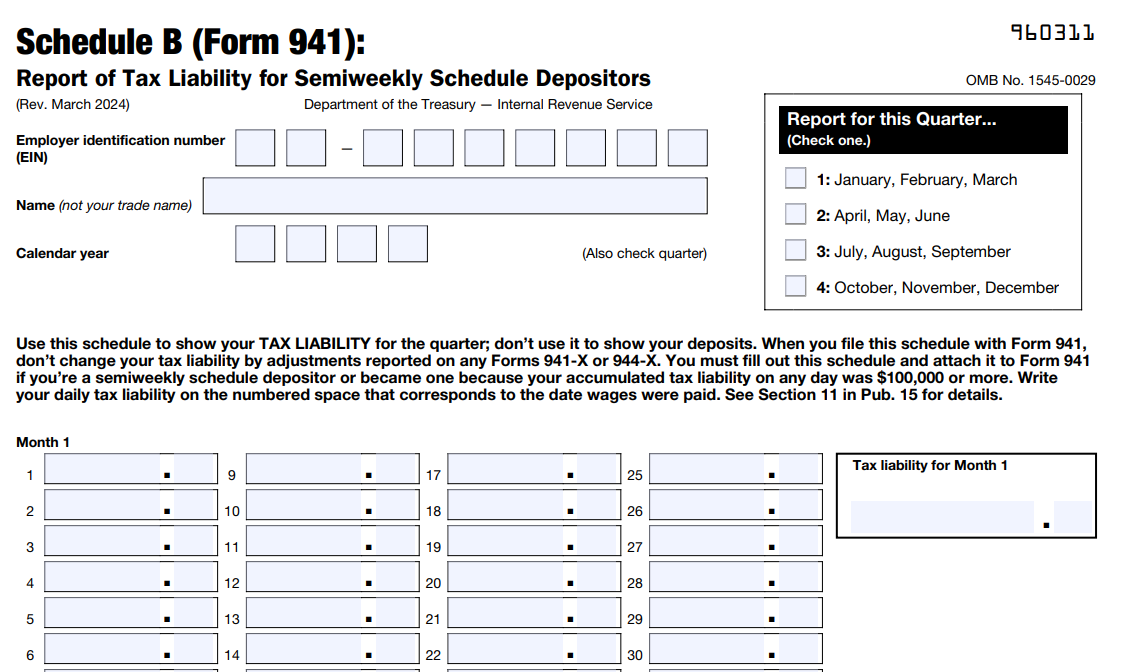

How to report tax liability for semiweekly deposits?

Schedule B (Form 941), is an IRS form that is used for reporting tax liability for semi-weekly pay schedules. 941 Schedule Bmust be completed if any one of the following conditions are satisfied:

- You are a semiweekly depositor having more than $50,000 of employment taxes during the previous lookback period.

- Your tax liability of $100,000 or more on any given day in the current or prior calendar year.

Learn more about Form 941 Schedule B.

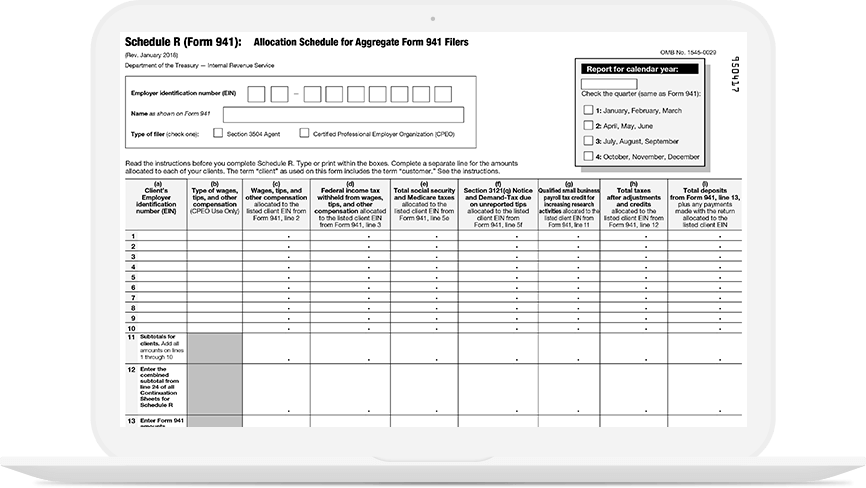

Are you an aggregate Form 941 filer?

We have a solution covered for you as well. Yes. We do support

Schedule R (Form 941), the Allocation Schedule for Aggregate Form 941 Filers.

Form 941 E-file pricing starts at just $5.95/return

Pricing includes Form 941 Schedule B, 8453-EMP, and Form 8974

Learn more about Form 941 Pricing

https://www.taxbandits.com/pricing/

High volume filers, please contact our support team to get a discount

on your filings.

Other Supported Forms

- Form 1099-NEC, Form 1099-K, INT, DIV, R, S, G, C, B, PATR & other 1099 Form

- ACA Forms: Form 1095-B, Form 1095-C

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 940, 940 Schedule R, 940-PR

Helpful Resources for Form 941

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and

e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

How Form 941 Impacts Year-End W-2 Preparation

Form 941 directly impacts year-end W-2 preparation by ensuring all quarterly payroll tax reports align with annual employee wage statements. The total wages, federal income taxes withheld, and Social Security and Medicare taxes reported on the four quarterly 941 forms must match the amounts listed on Form W-2 for all employees.

With TaxBandits, you can file both Form 941 and Form W-2 on the same platform, keeping your records safe and secure. You can easily file your Employee Form W-2 online with us.

Submit your BOI Report with Confidence

Tens of millions of (small) business owners will be required to file BOl reports online beginning January 1, 2024, under the federal Corporate Transparency Act (CTA), or face civil and criminal penalties. In other words, compliance is required. Fortunately, TaxBandits is here to help small business owners, as well as legal and accounting professionals, understand what they need to do right now.

Learn more about the features offered to simplify your BOI Filing.

Generate professional and accurate pay stubs with 123PayStubs

in a minute.

If you're looking to create pay stubs for your employees, 123PayStubs is here to help. With our user-friendly platform, you can generate professional and accurate pay stubs within a minute. Say goodbye to the hassle of manual calculations and tedious paperwork. Our Paystub generator provides you with convenient and efficient pay stub generation for your employees. Create your first pay stub for Free.